3.9: Logarithmic Regression

ECON 480 · Econometrics · Fall 2019

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/metricsf19

metricsF19.classes.ryansafner.com

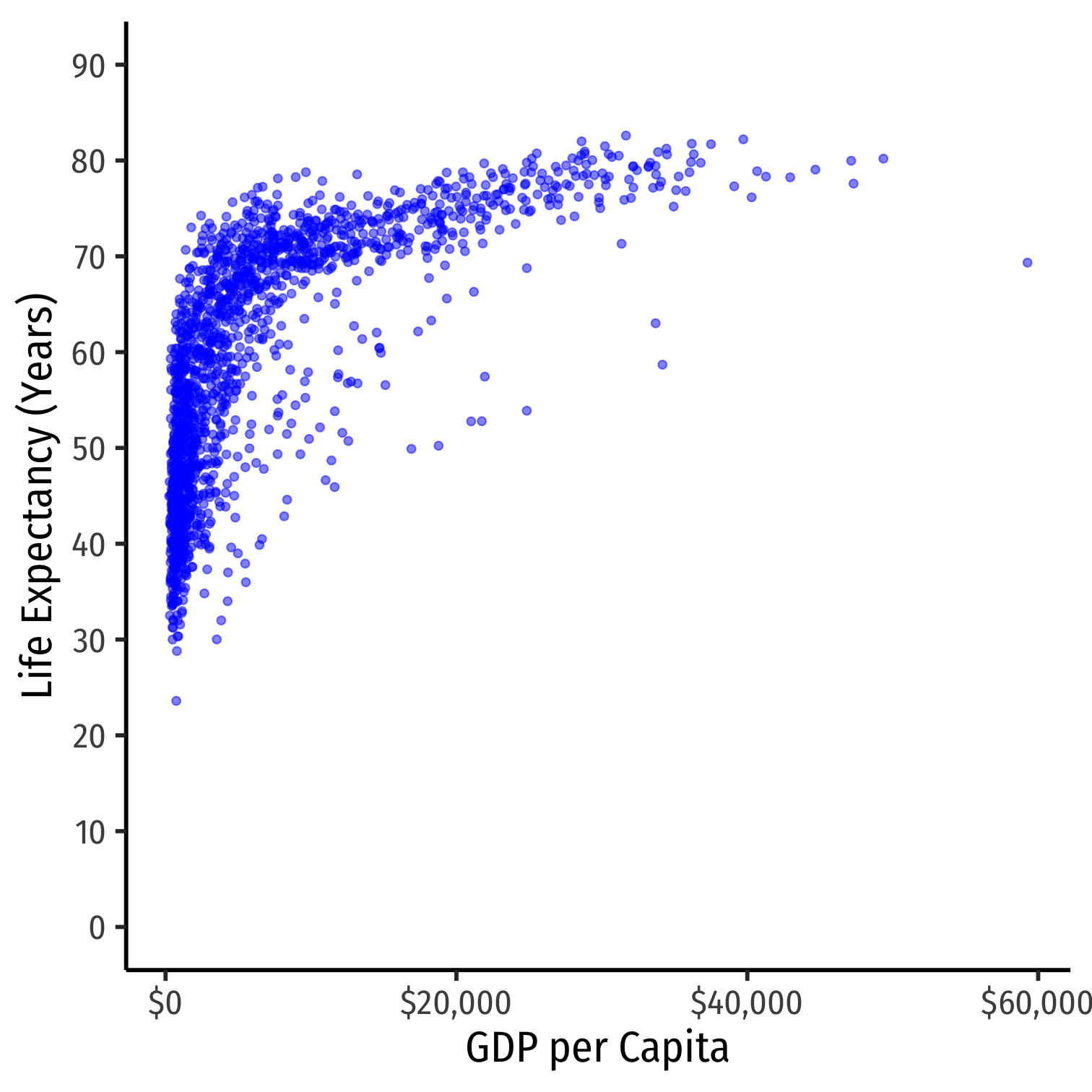

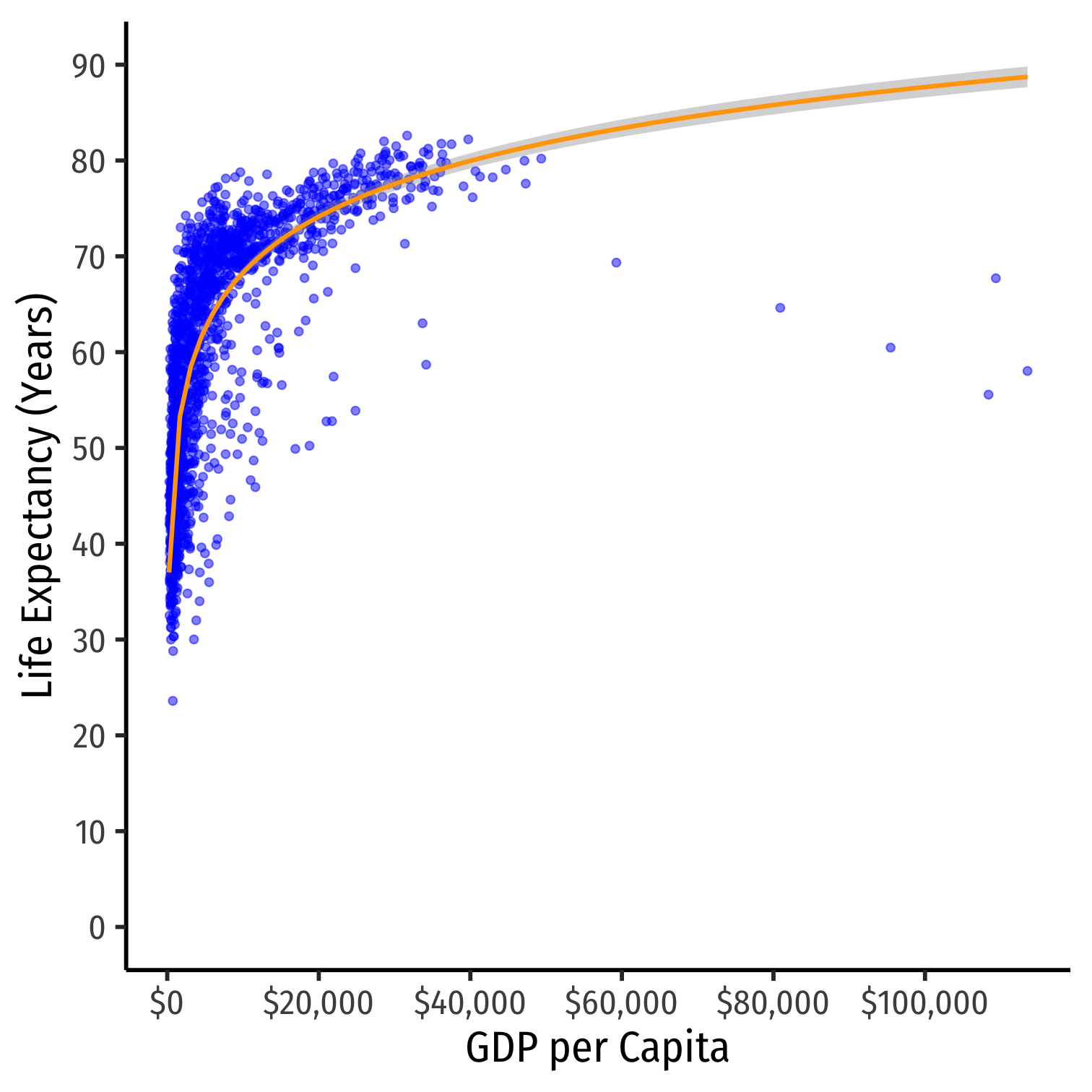

Nonlinearities

- Consider the

gapminderexample again

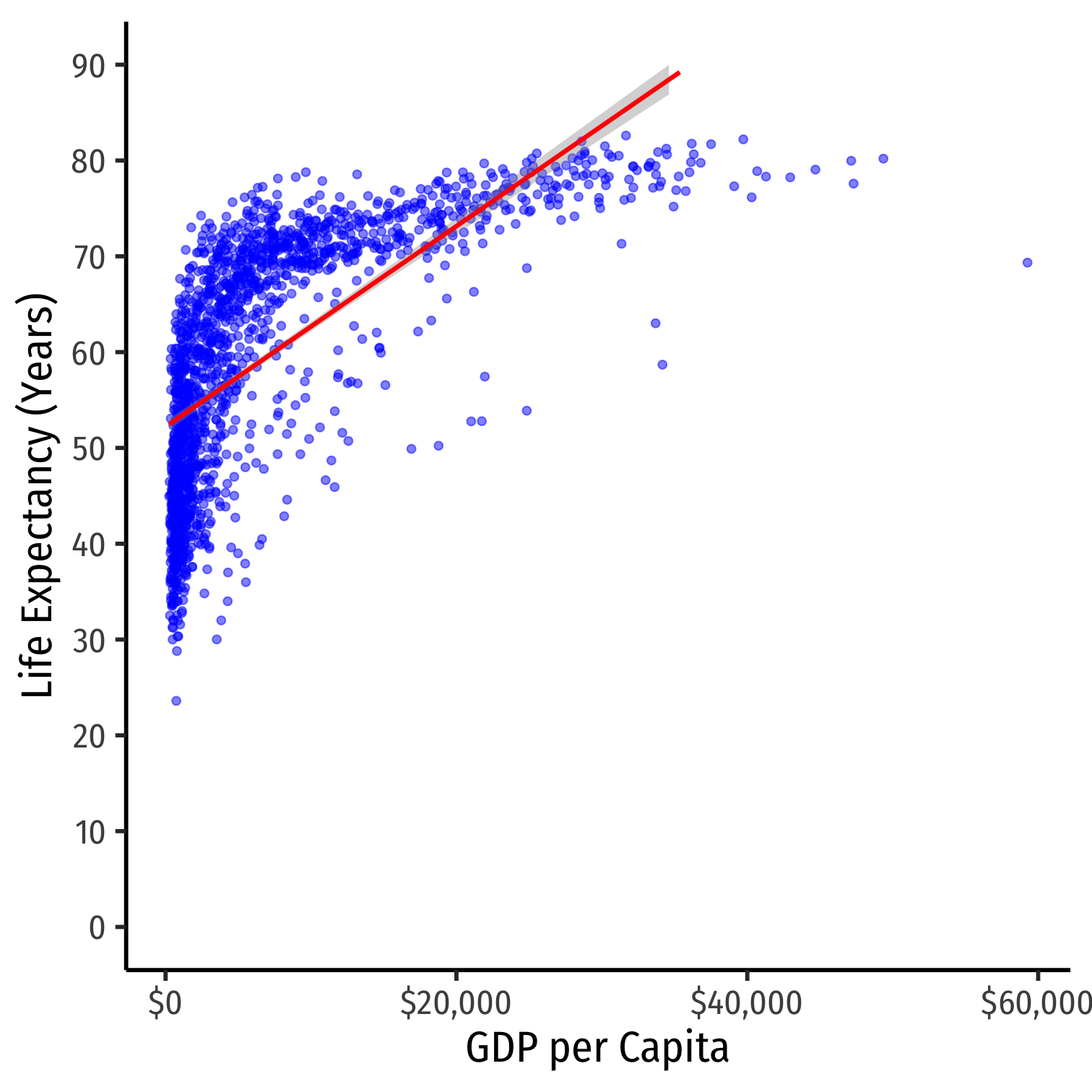

Nonlinearities

- Consider the

gapminderexample again- linear model

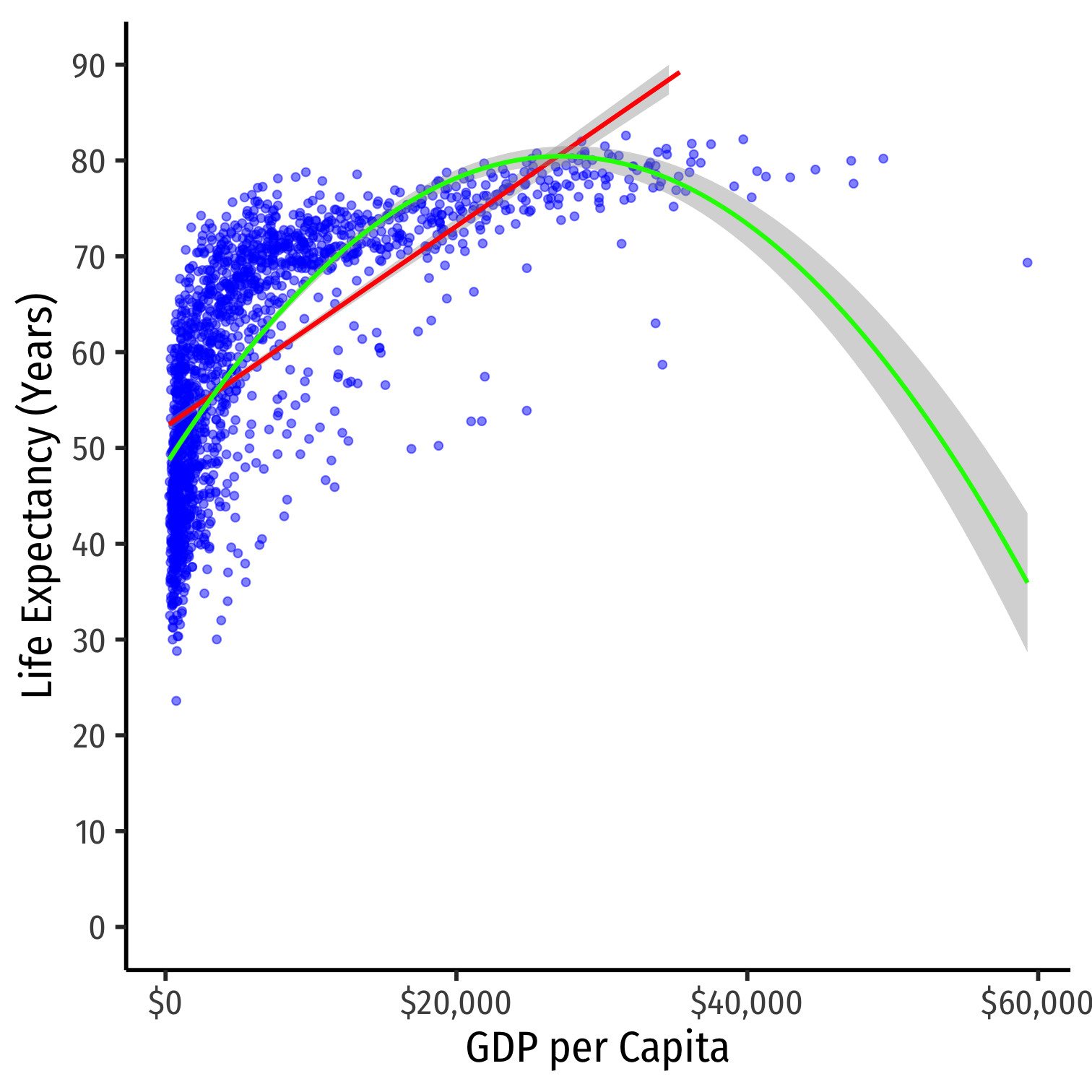

Nonlinearities

- Consider the

gapminderexample again- linear model

- polynomial model (quadratic)

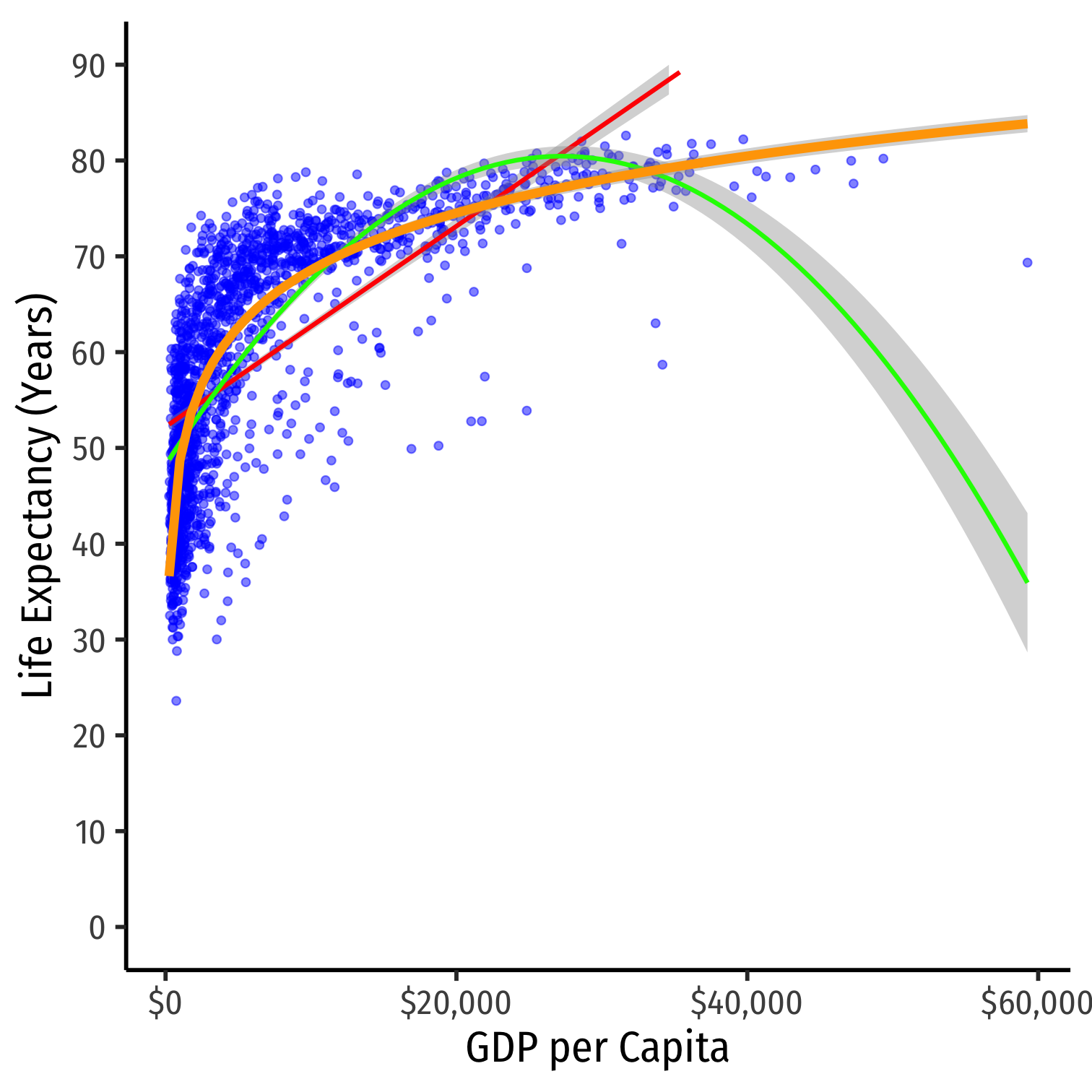

Nonlinearities

- Consider the

gapminderexample again- linear model

- polynomial model (quadratic)

- logarithmic model

Logarithmic Models

Logarithmic Models

Another model specification for nonlinear data is the logarithmic model1

- We transform either X, Y, or both by taking the (natural) logarithm

Logarithmic model has two additional advantages

- We can easily interpret coefficients as percentage changes or elasticities

- Useful economic shape: diminishing returns (production functions, utility functions, etc)

1 Note, this should not be confused with a logistic model, which is a model for dependent dummy variables.

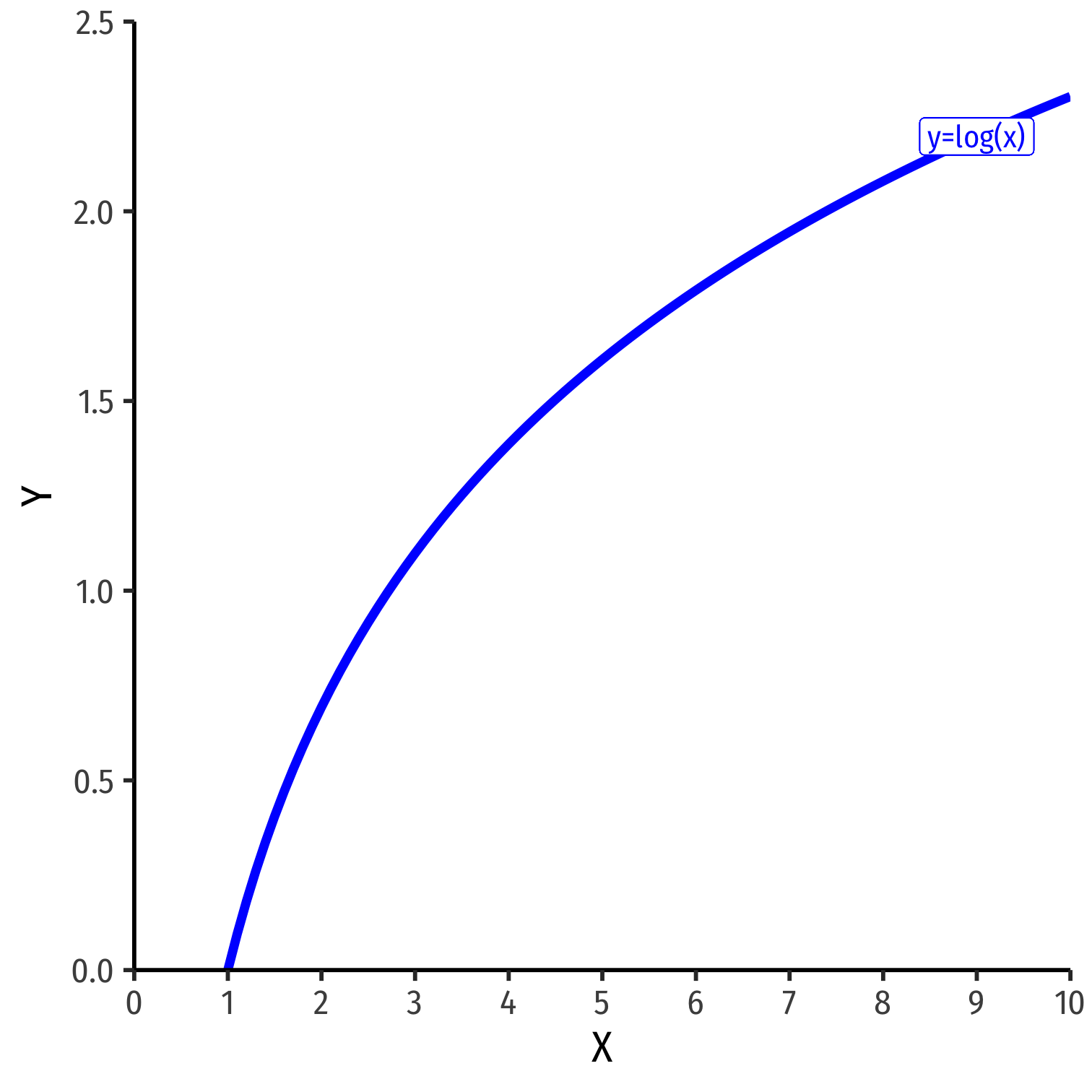

The Natural Logarithm

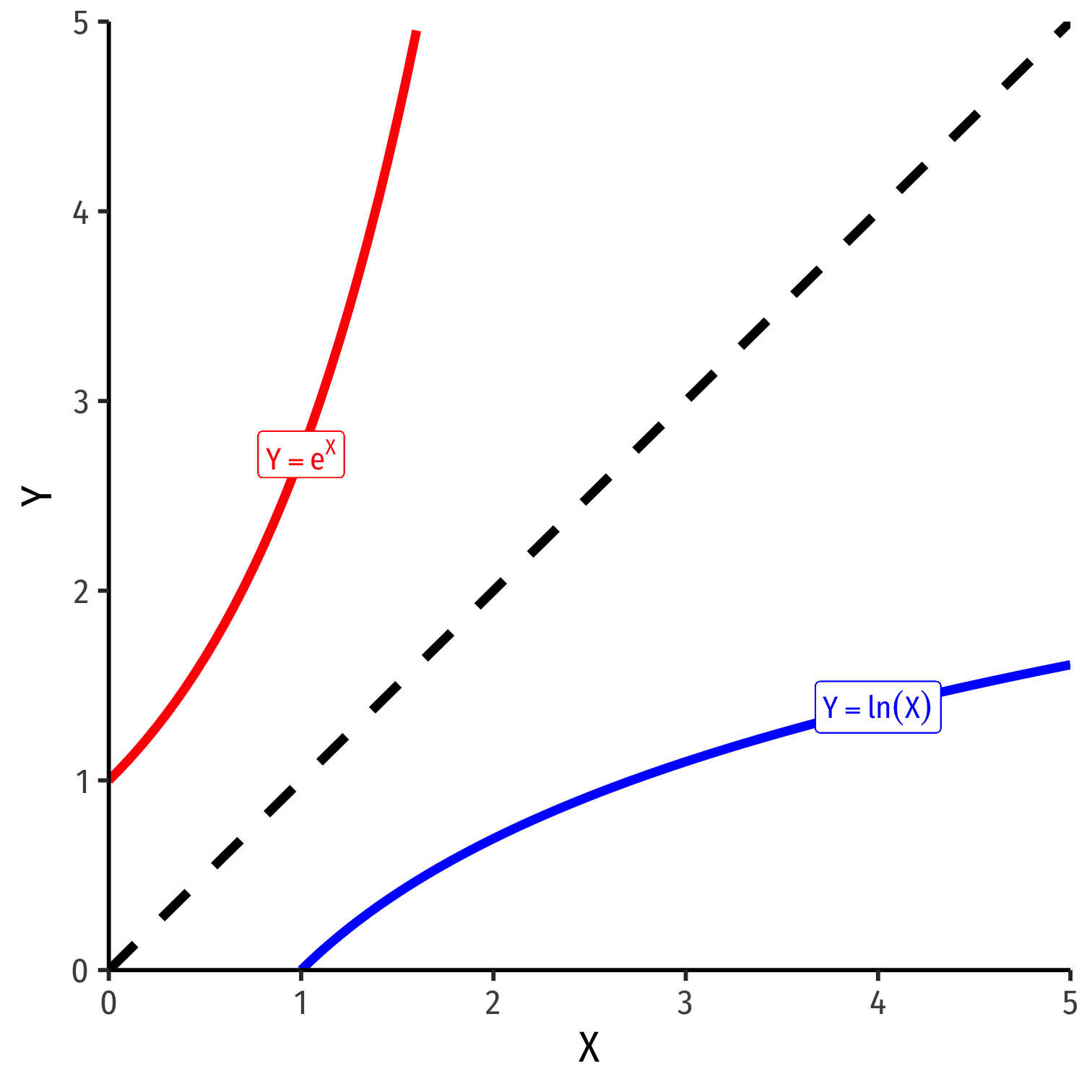

The exponential function, Y=eX or Y=exp(X), where base e=2.71828...

Natural logarithm is the inverse, Y=ln(X)

The Natural Logarithm: Review I

- Exponents are defined as

bn=b×b×⋯×b⏟n times

- where base b is multiplied by itself n times

The Natural Logarithm: Review I

- Exponents are defined as

bn=b×b×⋯×b⏟n times

- where base b is multiplied by itself n times

- Example: 23=2×2×2⏟n=3=8

The Natural Logarithm: Review I

- Exponents are defined as

bn=b×b×⋯×b⏟n times

- where base b is multiplied by itself n times

Example: 23=2×2×2⏟n=3=8

Logarithms are the inverse, defined as the exponents in the expressions above If bn=y, then logb(y)=n

- n is the number you must raise b to in order to get y

The Natural Logarithm: Review I

- Exponents are defined as

bn=b×b×⋯×b⏟n times

- where base b is multiplied by itself n times

Example: 23=2×2×2⏟n=3=8

Logarithms are the inverse, defined as the exponents in the expressions above If bn=y, then logb(y)=n

- n is the number you must raise b to in order to get y

Example: log2(8)=3

The Natural Logarithm: Review II

- Logarithms can have any base, but common to use the natural logarithm (ln) with base e=2.71828...

If en=y, then ln(y)=n

The Natural Logarithm: Properties

- Natural logs have a lot of useful properties:

ln(1x)=−ln(x)

ln(ab)=ln(a)+ln(b)

ln(xa)=ln(x)−ln(a)

ln(xa)=aln(x)

dlnxdx=1x

The Natural Logarithm: Example

- Most useful property: for small change in x, Δx:

ln(x+Δx)−ln(x)⏟Difference in logs≈Δxx⏟Relative change

The Natural Logarithm: Example

- Most useful property: for small change in x, Δx:

ln(x+Δx)−ln(x)⏟Difference in logs≈Δxx⏟Relative change

Example: Let x=100 and Δx=1, relative change is:

Δxx=(101−100)100=0.01 or 1%

- The logged difference:

ln(101)−ln(100)=0.00995≈1%

The Natural Logarithm: Example

- Most useful property: for small change in x, Δx:

ln(x+Δx)−ln(x)⏟Difference in logs≈Δxx⏟Relative change

Example: Let x=100 and Δx=1, relative change is:

Δxx=(101−100)100=0.01 or 1%

- The logged difference:

ln(101)−ln(100)=0.00995≈1%

- This allows us to very easily interpret coefficients as percent changes or elasticities

Elasticity

An elasticity between two variables, EY,X describes the responsiveness of one variable to a change in another

Measured in percentages: a 1% change in X will cause a E% change in Y

Elasticity

An elasticity between two variables, EY,X describes the responsiveness of one variable to a change in another

Measured in percentages: a 1% change in X will cause a E% change in Y

EY,X=%ΔY%ΔX=(ΔYY)(ΔXX)

Elasticity

An elasticity between two variables, EY,X describes the responsiveness of one variable to a change in another

Measured in percentages: a 1% change in X will cause a E% change in Y

EY,X=%ΔY%ΔX=(ΔYY)(ΔXX)

- Numerator is relative change in Y, Denominator is relative change in X

Math FYI: Cobb Douglas Functions and Logs

- One of the (many) reasons why economists love Cobb-Douglas functions:

Y=ALαKβ

Math FYI: Cobb Douglas Functions and Logs

One of the (many) reasons why economists love Cobb-Douglas functions: Y=ALαKβ

Taking logs, relationship becomes linear:

Math FYI: Cobb Douglas Functions and Logs

One of the (many) reasons why economists love Cobb-Douglas functions: Y=ALαKβ

Taking logs, relationship becomes linear:

ln(Y)=ln(A)+αln(L)+βln(K)

Math FYI: Cobb Douglas Functions and Logs

One of the (many) reasons why economists love Cobb-Douglas functions: Y=ALαKβ

Taking logs, relationship becomes linear:

ln(Y)=ln(A)+αln(L)+βln(K)

- With data on (Y,L,K) and linear regression, can estimate α and β

- α: elasticity of Y with respect to L

- A 1% change in L will lead to an α% change in Y

- β: elasticity of Y with respect to K

- A 1% change in K will lead to a β% change in Y

- α: elasticity of Y with respect to L

Logarithms in R I

- The

log()function can easily take the logarithm

gapminder<-gapminder %>% mutate(loggdp=log(gdpPercap)) # log GDP per capitagapminder %>% head() # look at it| ABCDEFGHIJ0123456789 |

country <fctr> | continent <fctr> | year <int> | lifeExp <dbl> | pop <int> | gdpPercap <dbl> | loggdp <dbl> |

|---|---|---|---|---|---|---|

| Afghanistan | Asia | 1952 | 28.801 | 8425333 | 779.4453 | 6.658583 |

| Afghanistan | Asia | 1957 | 30.332 | 9240934 | 820.8530 | 6.710344 |

| Afghanistan | Asia | 1962 | 31.997 | 10267083 | 853.1007 | 6.748878 |

| Afghanistan | Asia | 1967 | 34.020 | 11537966 | 836.1971 | 6.728864 |

| Afghanistan | Asia | 1972 | 36.088 | 13079460 | 739.9811 | 6.606625 |

| Afghanistan | Asia | 1977 | 38.438 | 14880372 | 786.1134 | 6.667101 |

Logarithms in R II

- Note,

log()by default is the natural logarithm ln(), i.e. basee- Can change base with e.g.

log(x, base = 5) - Some common built-in logs:

log10,log2

- Can change base with e.g.

log10(100)## [1] 2log2(16)## [1] 4log(19683, base=3)## [1] 9Types of Logarithmic Models

- Three types of log regression models, depending on which variables we log

Types of Logarithmic Models

- Three types of log regression models, depending on which variables we log

- Linear-log model: Yi=β0+β1 ln(Xi)

Types of Logarithmic Models

- Three types of log regression models, depending on which variables we log

Linear-log model: Yi=β0+β1 ln(Xi)

Log-linear model: ln(Yi) =β0+β1Xi

Types of Logarithmic Models

- Three types of log regression models, depending on which variables we log

Linear-log model: Yi=β0+β1 ln(Xi)

Log-linear model: ln(Yi) =β0+β1Xi

Log-log model: ln(Yi) =β0+β1 ln(Xi)

Linear-Log Model

- Linear-log model has an independent variable (X) that is logged

Linear-Log Model

- Linear-log model has an independent variable (X) that is logged

Y=β0+β1ln(X)β1=ΔY(ΔXX)

Linear-Log Model

- Linear-log model has an independent variable (X) that is logged

Y=β0+β1ln(X)β1=ΔY(ΔXX)

- Marginal effect of X→Y: a 1% change in X→ a β1100 unit change in Y

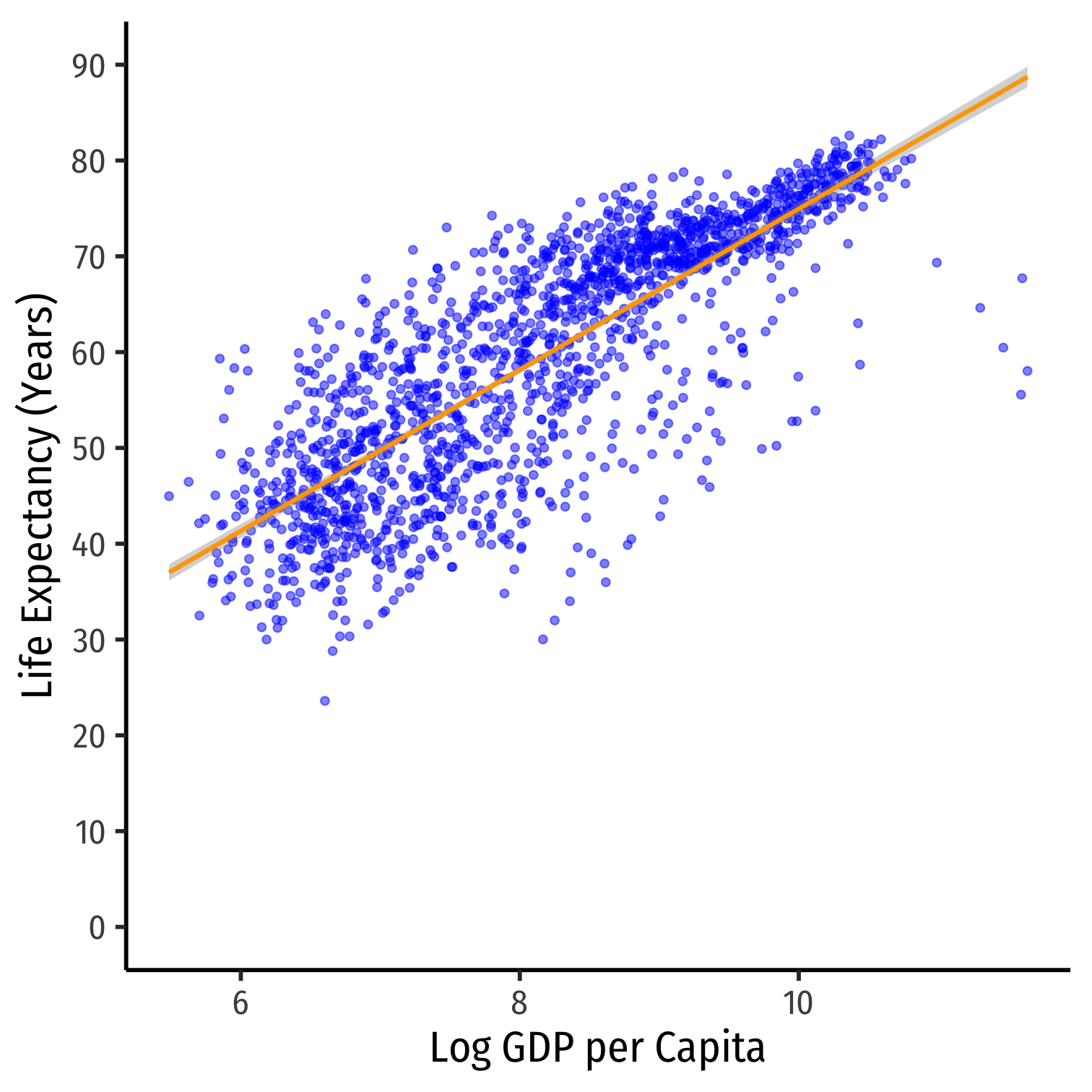

Linear-Log Model in R

lin_log_reg<-lm(lifeExp~loggdp, data = gapminder)library(broom)tidy(lin_log_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | -9.100889 | 1.227674 | |

| loggdp | 8.405085 | 0.148762 |

^Life Expectancyi=−9.10+9.41ln(GDP)i

Linear-Log Model in R

lin_log_reg<-lm(lifeExp~loggdp, data = gapminder)library(broom)tidy(lin_log_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | -9.100889 | 1.227674 | |

| loggdp | 8.405085 | 0.148762 |

^Life Expectancyi=−9.10+9.41ln(GDP)i

- A 1% change in GDP → a 9.41100= 0.0941 year increase in Life Expectancy

Linear-Log Model in R

lin_log_reg<-lm(lifeExp~loggdp, data = gapminder)library(broom)tidy(lin_log_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | -9.100889 | 1.227674 | |

| loggdp | 8.405085 | 0.148762 |

^Life Expectancyi=−9.10+9.41ln(GDP)i

A 1% change in GDP → a 9.41100= 0.0941 year increase in Life Expectancy

A 25% fall in GDP → a (−25×0.0941)= 2.353 year decrease in Life Expectancy

Linear-Log Model in R

lin_log_reg<-lm(lifeExp~loggdp, data = gapminder)library(broom)tidy(lin_log_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | -9.100889 | 1.227674 | |

| loggdp | 8.405085 | 0.148762 |

^Life Expectancyi=−9.10+9.41ln(GDP)i

A 1% change in GDP → a 9.41100= 0.0941 year increase in Life Expectancy

A 25% fall in GDP → a (−25×0.0941)= 2.353 year decrease in Life Expectancy

A 100% rise in GDP → a (100×0.0941)= 9.041 year increase in Life Expectancy

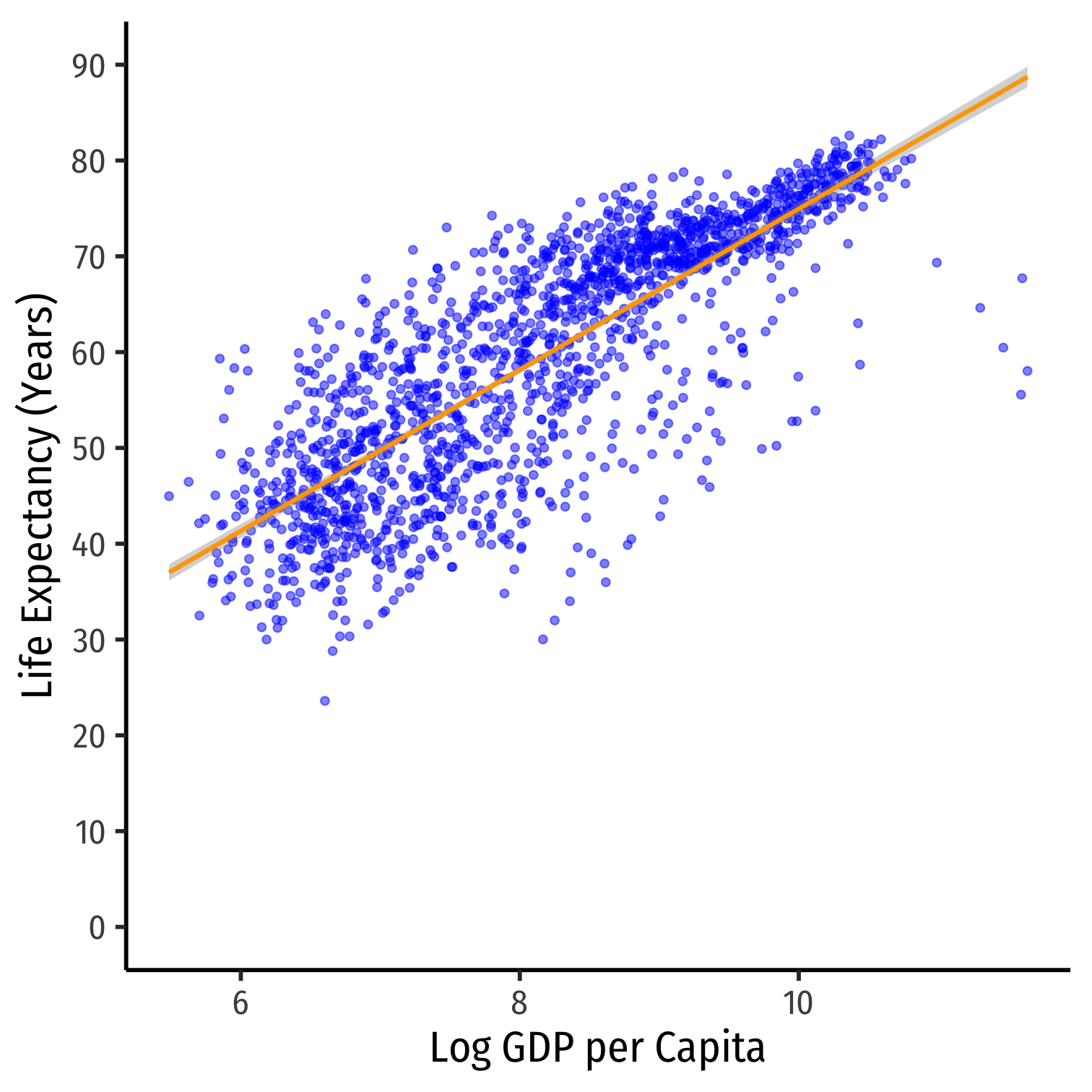

Linear-Log Model Graph I

ggplot(data = gapminder)+ aes(x = gdpPercap, y = lifeExp)+ geom_point(color="blue", alpha=0.5)+ geom_smooth(method="lm", formula=y~log(x), color="orange")+ scale_x_continuous(labels=scales::dollar, breaks=seq(0,120000,20000))+ scale_y_continuous(breaks=seq(0,90,10), limits=c(0,90))+ labs(x = "GDP per Capita", y = "Life Expectancy (Years)")+ theme_classic(base_family = "Fira Sans Condensed", base_size=20)

Linear-Log Model Graph II

ggplot(data = gapminder)+ aes(x = loggdp, y = lifeExp)+ geom_point(color="blue", alpha=0.5)+ geom_smooth(method="lm", color="orange")+ scale_y_continuous(breaks=seq(0,90,10), limits=c(0,90))+ labs(x = "Log GDP per Capita", y = "Life Expectancy (Years)")+ theme_classic(base_family = "Fira Sans Condensed", base_size=20)

Log-Linear Model

- Log-linear model has the dependent variable (Y) logged

Log-Linear Model

- Log-linear model has the dependent variable (Y) logged

ln(Y)=β0+β1Xβ1=(ΔYY)ΔX

Log-Linear Model

- Log-linear model has the dependent variable (Y) logged

ln(Y)=β0+β1Xβ1=(ΔYY)ΔX

- Marginal effect of X→Y: a 1 unit change in X→ a β1×100 % change in Y

Log-Linear Model in R (Preliminaries)

We will again have very large/small coefficients if we deal with GDP directly, again let's transform

gdpPercapinto $1,000s, call itgdp_tThen log LifeExp

Log-Linear Model in R (Preliminaries)

We will again have very large/small coefficients if we deal with GDP directly, again let's transform

gdpPercapinto $1,000s, call itgdp_tThen log LifeExp

gapminder <- gapminder %>% mutate(gdp_t=gdpPercap/1000, # first make GDP/capita in $1000s loglife=log(lifeExp)) # take the log of LifeExpgapminder %>% head() # look at it| ABCDEFGHIJ0123456789 |

country <fctr> | continent <fctr> | year <int> | lifeExp <dbl> | pop <int> | gdpPercap <dbl> | loggdp <dbl> | gdp_t <dbl> | loglife <dbl> |

|---|---|---|---|---|---|---|---|---|

| Afghanistan | Asia | 1952 | 28.801 | 8425333 | 779.4453 | 6.658583 | 0.7794453 | 3.360410 |

| Afghanistan | Asia | 1957 | 30.332 | 9240934 | 820.8530 | 6.710344 | 0.8208530 | 3.412203 |

| Afghanistan | Asia | 1962 | 31.997 | 10267083 | 853.1007 | 6.748878 | 0.8531007 | 3.465642 |

| Afghanistan | Asia | 1967 | 34.020 | 11537966 | 836.1971 | 6.728864 | 0.8361971 | 3.526949 |

| Afghanistan | Asia | 1972 | 36.088 | 13079460 | 739.9811 | 6.606625 | 0.7399811 | 3.585960 |

| Afghanistan | Asia | 1977 | 38.438 | 14880372 | 786.1134 | 6.667101 | 0.7861134 | 3.649047 |

Log-Linear Model in R

log_lin_reg<-lm(loglife~gdp_t, data = gapminder)tidy(log_lin_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | 3.966639 | 0.0058345501 | |

| gdp_t | 0.012917 | 0.0004777072 |

^ln(Life Expectancy)i=3.967+0.013GDPi

Log-Linear Model in R

log_lin_reg<-lm(loglife~gdp_t, data = gapminder)tidy(log_lin_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | 3.966639 | 0.0058345501 | |

| gdp_t | 0.012917 | 0.0004777072 |

^ln(Life Expectancy)i=3.967+0.013GDPi

- A $1 (thousand) change in GDP → a 0.013×100%= 1.3% increase in Life Expectancy

Log-Linear Model in R

log_lin_reg<-lm(loglife~gdp_t, data = gapminder)tidy(log_lin_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | 3.966639 | 0.0058345501 | |

| gdp_t | 0.012917 | 0.0004777072 |

^ln(Life Expectancy)i=3.967+0.013GDPi

A $1 (thousand) change in GDP → a 0.013×100%= 1.3% increase in Life Expectancy

A $25 (thousand) fall in GDP → a (−25×1.3%)= 32.5% decrease in Life Expectancy

Log-Linear Model in R

log_lin_reg<-lm(loglife~gdp_t, data = gapminder)tidy(log_lin_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | 3.966639 | 0.0058345501 | |

| gdp_t | 0.012917 | 0.0004777072 |

^ln(Life Expectancy)i=3.967+0.013GDPi

A $1 (thousand) change in GDP → a 0.013×100%= 1.3% increase in Life Expectancy

A $25 (thousand) fall in GDP → a (−25×1.3%)= 32.5% decrease in Life Expectancy

A $100 (thousand) rise in GDP → a (100×1.3%)= 130% increase in Life Expectancy

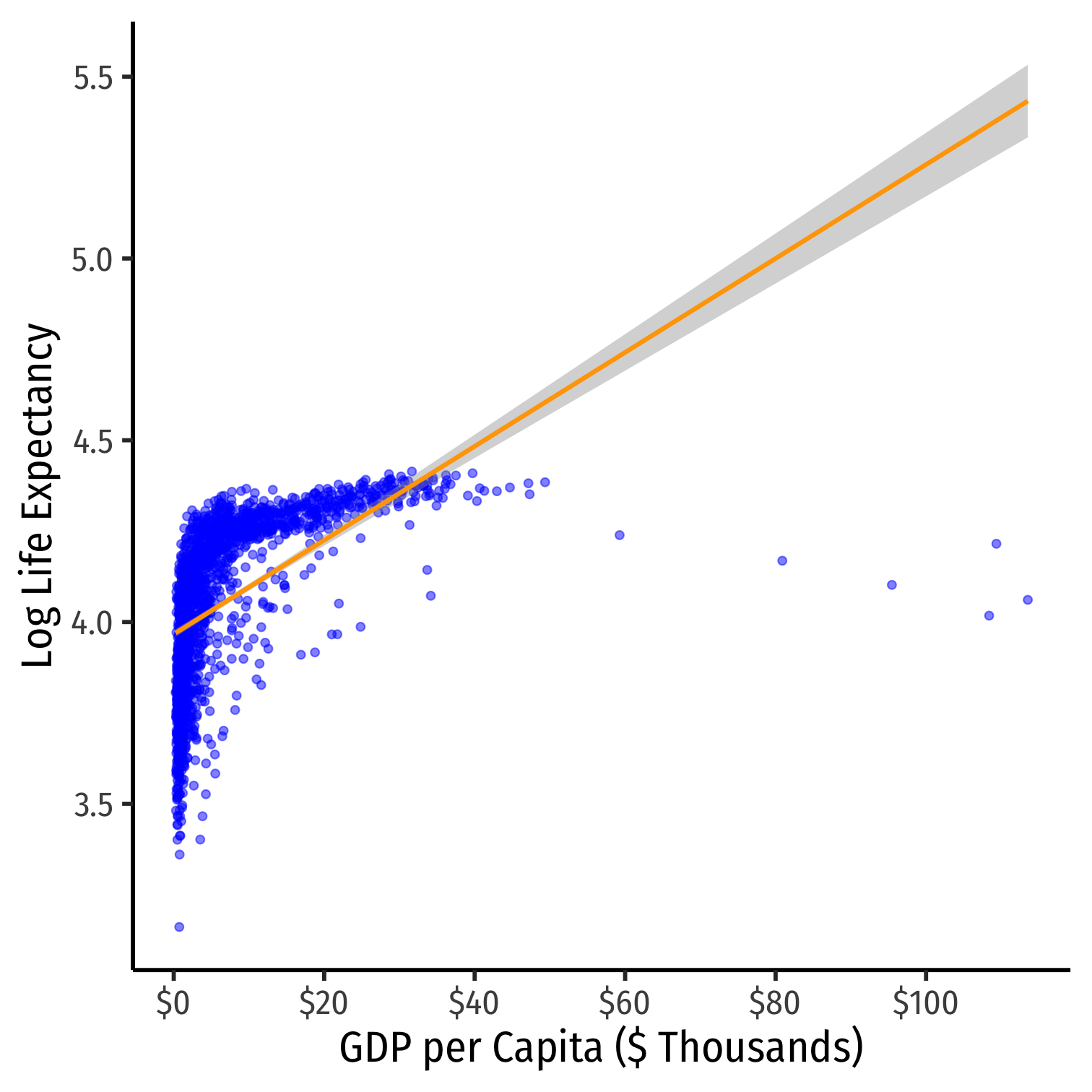

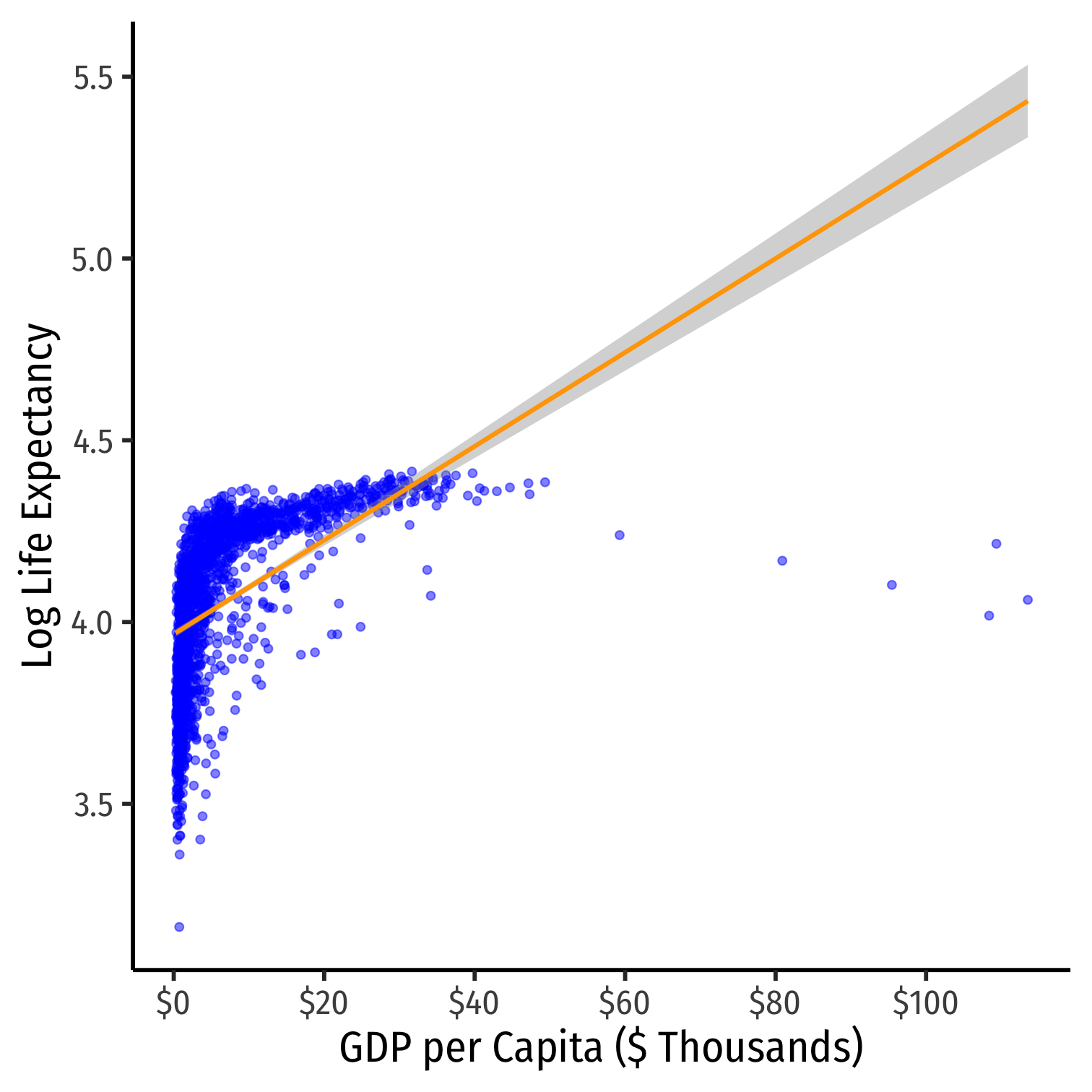

Linear-Log Model Graph I

ggplot(data = gapminder)+ aes(x = gdp_t, y = loglife)+ geom_point(color="blue", alpha=0.5)+ geom_smooth(method="lm", color="orange")+ scale_x_continuous(labels=scales::dollar, breaks=seq(0,120,20))+ labs(x = "GDP per Capita ($ Thousands)", y = "Log Life Expectancy")+ theme_classic(base_family = "Fira Sans Condensed", base_size=20)

Log-Log Model

- Log-log model has both variables (X and Y) logged

Log-Log Model

- Log-log model has both variables (X and Y) logged

ln(Y)=β0+β1ln(X)β1=(ΔYY)(ΔXX)

Log-Log Model

- Log-log model has both variables (X and Y) logged

ln(Y)=β0+β1ln(X)β1=(ΔYY)(ΔXX)

Marginal effect of X→Y: a 1% change in X→ a β1 % change in Y

β1 is the elasticity of Y with respect to X!

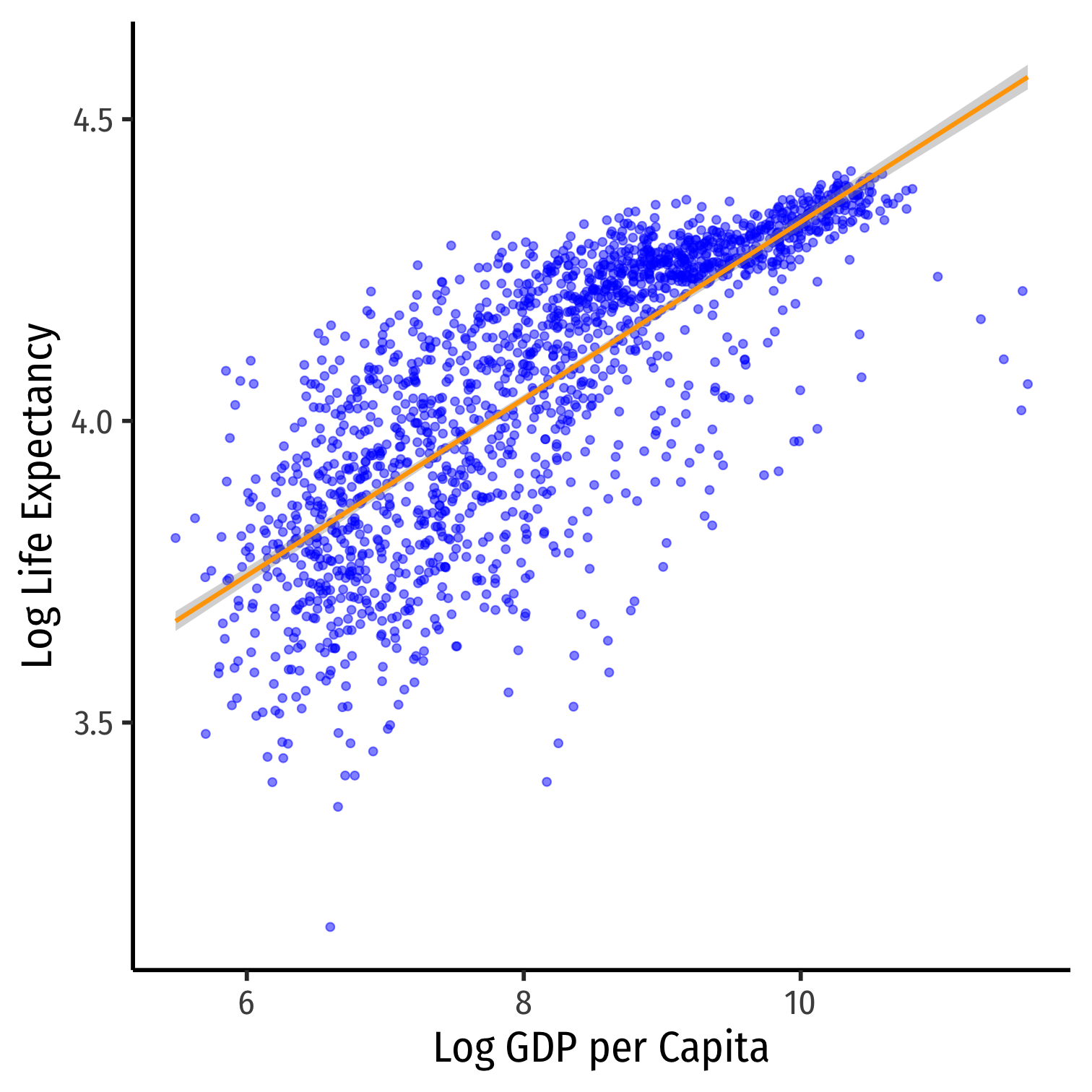

Log-Log Model in R

log_log_reg<-lm(loglife~loggdp, data = gapminder)tidy(log_log_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | 2.864177 | 0.02328274 | |

| loggdp | 0.146549 | 0.00282126 |

^ln(Life Expectancy)i=2.864+0.147ln(GDP)i

Log-Log Model in R

log_log_reg<-lm(loglife~loggdp, data = gapminder)tidy(log_log_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | 2.864177 | 0.02328274 | |

| loggdp | 0.146549 | 0.00282126 |

^ln(Life Expectancy)i=2.864+0.147ln(GDP)i

- A 1% change in GDP → a 0.147% increase in Life Expectancy

Log-Log Model in R

log_log_reg<-lm(loglife~loggdp, data = gapminder)tidy(log_log_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | 2.864177 | 0.02328274 | |

| loggdp | 0.146549 | 0.00282126 |

^ln(Life Expectancy)i=2.864+0.147ln(GDP)i

A 1% change in GDP → a 0.147% increase in Life Expectancy

A 25% fall in GDP → a (−25×0.147%)= 3.675% decrease in Life Expectancy

Log-Log Model in R

log_log_reg<-lm(loglife~loggdp, data = gapminder)tidy(log_log_reg)| ABCDEFGHIJ0123456789 |

term <chr> | estimate <dbl> | std.error <dbl> | |

|---|---|---|---|

| (Intercept) | 2.864177 | 0.02328274 | |

| loggdp | 0.146549 | 0.00282126 |

^ln(Life Expectancy)i=2.864+0.147ln(GDP)i

A 1% change in GDP → a 0.147% increase in Life Expectancy

A 25% fall in GDP → a (−25×0.147%)= 3.675% decrease in Life Expectancy

A 100% rise in GDP → a (100×0.147%)= 14.7% increase in Life Expectancy

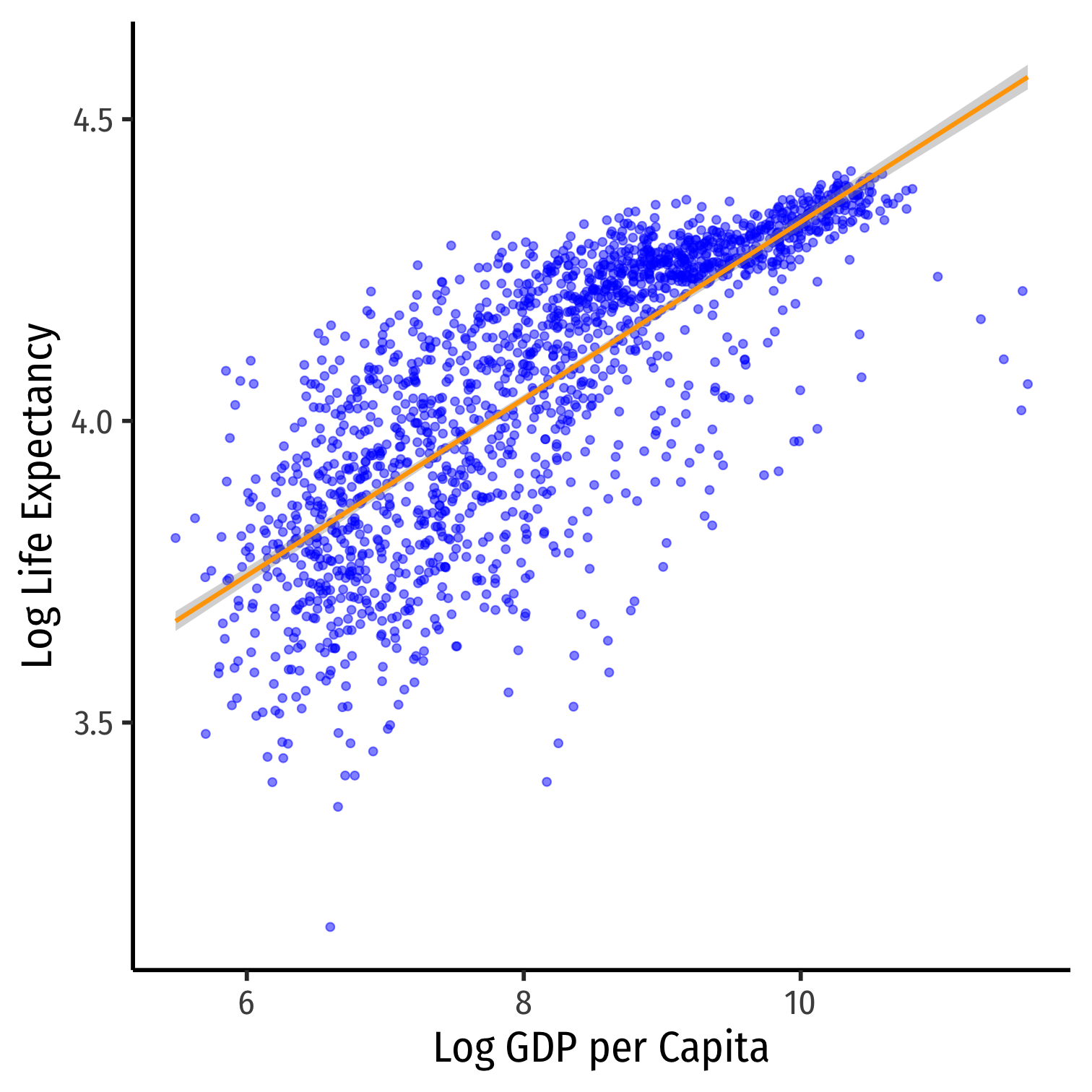

Log-Log Model Graph I

ggplot(data = gapminder)+ aes(x = loggdp, y = loglife)+ geom_point(color="blue", alpha=0.5)+ geom_smooth(method="lm", color="orange")+ labs(x = "Log GDP per Capita", y = "Log Life Expectancy")+ theme_classic(base_family = "Fira Sans Condensed", base_size=20)

Comparing Models I

| Model | Equation | Interpretation |

|---|---|---|

| Linear-Log | Y=β0+β1ln(X) | 1% change in X→^β1100 unit change in Y |

| Log-Linear | ln(Y)=β0+β1X | 1 unit change in X→^β1×100% change in Y |

| Log-Log | ln(Y)=β0+β1ln(X) | 1% change in X→^β1% change in Y |

- Hint: the variable that gets logged changes in percent terms, the variable not logged changes in unit terms

Comparing Models II

library(huxtable)huxreg("Life Exp." = lin_log_reg, "Log Life Exp." = log_lin_reg, "Log Life Exp." = log_log_reg, coefs = c("Constant" = "(Intercept)", "GDP ($1000s)" = "gdp_t", "Log GDP" = "loggdp"), statistics = c("N" = "nobs", "R-Squared" = "r.squared", "SER" = "sigma"), number_format = 2)- Models are very different units, how to choose?

- Compare R2's

- Compare graphs

- Compare intution

| Life Exp. | Log Life Exp. | Log Life Exp. | |

| Constant | -9.10 *** | 3.97 *** | 2.86 *** |

| (1.23) | (0.01) | (0.02) | |

| GDP ($1000s) | 0.01 *** | ||

| (0.00) | |||

| Log GDP | 8.41 *** | 0.15 *** | |

| (0.15) | (0.00) | ||

| N | 1704 | 1704 | 1704 |

| R-Squared | 0.65 | 0.30 | 0.61 |

| SER | 7.62 | 0.19 | 0.14 |

| *** p < 0.001; ** p < 0.01; * p < 0.05. | |||

Comparing Models III

| Linear-Log | Log-Linear | Log-Log |

|---|---|---|

|

|

|

| ^Yi=^β0+^β1ln(Xi) | ln(^Yi)=^β0+^β1Xi | ln(^Yi)=^β0+^β1ln(Xi) |

| R2=0.65 | R2=0.30 | R2=0.61 |

When to Log?

- In practice, the following types of variables are logged:

- Variables that must always be positive (prices, sales, market values)

- Very large numbers (population, GDP)

- Variables we want to talk about as percentage changes or growth rates (money supply, population, GDP)

- Variables that have diminishing returns (output, utility)

- Variables that have nonlinear scatterplots

When to Log?

In practice, the following types of variables are logged:

- Variables that must always be positive (prices, sales, market values)

- Very large numbers (population, GDP)

- Variables we want to talk about as percentage changes or growth rates (money supply, population, GDP)

- Variables that have diminishing returns (output, utility)

- Variables that have nonlinear scatterplots

Avoid logs for:

- Variables that are less than one, decimals, 0, or negative

- Categorical variables (season, gender, political party)

- Time variables (year, week, day)

Comparing Across Units

Comparing Coefficients of Different Units I

^Yi=β0+β1X1+β2X2

We often want to compare coefficients to see which variable X1 or X2 has a bigger effect on Y

What if X1 and X2 are different units?

Example: ^Salaryi=β0+β1Batting averagei+β2Home runsi^Salaryi=−2,869,439.40+12,417,629.72Batting averagei+129,627.36Home runsi

Comparing Coefficients of Different Units II

- An easy way is to standardize the variables (i.e. take the Z-score)

Xstd=X−¯Xsd(X)

Comparing Coefficients of Different Units: Example

| Variable | Mean | Std. Dev. |

|---|---|---|

| Salary | $2,024,616 | $2,764,512 |

| Batting Average | 0.267 | 0.031 |

| Home Runs | 12.11 | 10.31 |

^Salaryi=−2,869,439.40+12,417,629.72Batting averagei+129,627.36Home runsi^Salaryistd=0.00+0.14Batting averagestdi+0.48Home runsstdi

Comparing Coefficients of Different Units: Example

| Variable | Mean | Std. Dev. |

|---|---|---|

| Salary | $2,024,616 | $2,764,512 |

| Batting Average | 0.267 | 0.031 |

| Home Runs | 12.11 | 10.31 |

^Salaryi=−2,869,439.40+12,417,629.72Batting averagei+129,627.36Home runsi^Salaryistd=0.00+0.14Batting averagestdi+0.48Home runsstdi

- Marginal effect on Y (in standard deviations of Y) from 1 standard deviation change in X

- ^β1: a 1 standard deviation increase in Batting Average increases Salary by 0.14 standard deviations

- $0.14 \times 2,764,512=\$387,032$

- ^β2: a 1 standard deviation increase in Home Runs increases Salary by 0.48 standard deviations

- $0.48 \times 2,764,512=\$1,326,966$

Standardizing in R

- Use the

scale()command insidemutate()function to standardize a variable

gapminder<-gapminder %>% mutate(std_life = scale(lifeExp), std_gdp = scale(gdpPercap)) std_reg<-lm(std_life~std_gdp, data = gapminder)tidy(std_reg)| term | estimate | std.error | statistic | p.value |

| (Intercept) | 1.1e-16 | 0.0197 | 5.57e-15 | 1 |

| std_gdp | 0.584 | 0.0197 | 29.7 | 3.57e-156 |

Joint Hypothesis Testing

Joint Hypothesis Testing I

Example: Return again to:

^Wagei=^β0+^β1Male+^β2Northeasti+^β3Midwesti+^β4Southi

Joint Hypothesis Testing I

Example: Return again to:

^Wagei=^β0+^β1Male+^β2Northeasti+^β3Midwesti+^β4Southi

- Maybe region doesn't affect wages at all?

Joint Hypothesis Testing I

Example: Return again to:

^Wagei=^β0+^β1Male+^β2Northeasti+^β3Midwesti+^β4Southi

Maybe region doesn't affect wages at all?

H0:β2=0,β3=0,β4=0

Joint Hypothesis Testing I

Example: Return again to:

^Wagei=^β0+^β1Male+^β2Northeasti+^β3Midwesti+^β4Southi

Maybe region doesn't affect wages at all?

H0:β2=0,β3=0,β4=0

This is a joint hypothesis to test

Joint Hypothesis Testing II

- A joint hypothesis tests against the null hypothesis of a value for multiple parameters:

H0:β1=β2=0the hypotheses that multiple regressors are equal to zero (have no causal effect on the outcome)

Joint Hypothesis Testing II

A joint hypothesis tests against the null hypothesis of a value for multiple parameters: H0:β1=β2=0

the hypotheses that multiple regressors are equal to zero (have no causal effect on the outcome)Our alternative hypothesis is that: H1: either β1≠0 or β2≠0 or both

or simply, that H0 is not true

Types of Joint Hypothesis Tests

- Three main cases of joint hypothesis tests:

Types of Joint Hypothesis Tests

- Three main cases of joint hypothesis tests:

- H0: β1=β2=0

- Testing against the claim that multiple variables don't matter

- Useful under high multicollinearity between variables

- Ha: at least one parameter ≠ 0

Types of Joint Hypothesis Tests

- Three main cases of joint hypothesis tests:

H0: β1=β2=0

- Testing against the claim that multiple variables don't matter

- Useful under high multicollinearity between variables

- Ha: at least one parameter ≠ 0

H0: β1=β2

- Testing whether two variables matter the same

- Variables must be the same units

- Ha:β1(≠,<, or >)β2

Types of Joint Hypothesis Tests

- Three main cases of joint hypothesis tests:

H0: β1=β2=0

- Testing against the claim that multiple variables don't matter

- Useful under high multicollinearity between variables

- Ha: at least one parameter ≠ 0

H0: β1=β2

- Testing whether two variables matter the same

- Variables must be the same units

- Ha:β1(≠,<, or >)β2

H0: ALL β's =0

- The "Overall F-test"

- Testing against claim that regression model explains NO variation in Y

Joint Hypothesis Tests: F-statistic

- The F-statistic is the test-statistic used to test joint hypotheses about regression coefficients with an F-test

Joint Hypothesis Tests: F-statistic

The F-statistic is the test-statistic used to test joint hypotheses about regression coefficients with an F-test

This involves comparing two models:

- Unrestricted model: regression with all coefficients

- Restricted model: regression under null hypothesis (coefficients equal hypothesized values)

Joint Hypothesis Tests: F-statistic

The F-statistic is the test-statistic used to test joint hypotheses about regression coefficients with an F-test

This involves comparing two models:

- Unrestricted model: regression with all coefficients

- Restricted model: regression under null hypothesis (coefficients equal hypothesized values)

F is an analysis of variance (ANOVA)

- essentially tests whether R2 increases statistically significantly as we go from the restricted model$\rightarrow$unrestricted model

Joint Hypothesis Tests: F-statistic

The F-statistic is the test-statistic used to test joint hypotheses about regression coefficients with an F-test

This involves comparing two models:

- Unrestricted model: regression with all coefficients

- Restricted model: regression under null hypothesis (coefficients equal hypothesized values)

F is an analysis of variance (ANOVA)

- essentially tests whether R2 increases statistically significantly as we go from the restricted model$\rightarrow$unrestricted model

F has its own distribution, with two sets of degrees of freedom

Joint Hypothesis F-test: Example I

Example: Return again to:

^Wagei=^β0+^β1Malei+^β2Northeasti+^β3Midwesti+^β4Southi

Joint Hypothesis F-test: Example I

Example: Return again to:

^Wagei=^β0+^β1Malei+^β2Northeasti+^β3Midwesti+^β4Southi

- H0:β2=β3=β4=0

Joint Hypothesis F-test: Example I

Example: Return again to:

^Wagei=^β0+^β1Malei+^β2Northeasti+^β3Midwesti+^β4Southi

H0:β2=β3=β4=0

Ha: H0 is not true (at least one βi≠0)

Joint Hypothesis F-test: Example II

Example: Return again to:

^Wagei=^β0+^β1Malei+^β2Northeasti+^β3Midwesti+^β4Southi

- Unrestricted model:

^Wagei=^β0+^β1Malei+^β2Northeasti+^β3Midwesti+^β4Southi

Joint Hypothesis F-test: Example II

Example: Return again to:

^Wagei=^β0+^β1Malei+^β2Northeasti+^β3Midwesti+^β4Southi

- Unrestricted model:

^Wagei=^β0+^β1Malei+^β2Northeasti+^β3Midwesti+^β4Southi

- Restricted model:

^Wagei=^β0+^β1Malei

Joint Hypothesis F-test: Example II

Example: Return again to:

^Wagei=^β0+^β1Malei+^β2Northeasti+^β3Midwesti+^β4Southi

- Unrestricted model:

^Wagei=^β0+^β1Malei+^β2Northeasti+^β3Midwesti+^β4Southi

- Restricted model:

^Wagei=^β0+^β1Malei

- F: does going from restricted to unrestricted statistically significantly improve R2?

Calculating the F-statistic

Fq,(n−k−1)=((R2u−R2r)q)((1−R2u)(n−k−1))

Calculating the F-statistic

Fq,(n−k−1)=((R2u−R2r)q)((1−R2u)(n−k−1))

- R2u: the R2 from the unrestricted model (all variables)

Calculating the F-statistic

Fq,(n−k−1)=((R2u−R2r)q)((1−R2u)(n−k−1))

R2u: the R2 from the unrestricted model (all variables)

R2r: the R2 from the restricted model (null hypothesis)

Calculating the F-statistic

Fq,(n−k−1)=((R2u−R2r)q)((1−R2u)(n−k−1))

R2u: the R2 from the unrestricted model (all variables)

R2r: the R2 from the restricted model (null hypothesis)

q: number of restrictions (number of β′s=0 under null hypothesis)

Calculating the F-statistic

Fq,(n−k−1)=((R2u−R2r)q)((1−R2u)(n−k−1))

R2u: the R2 from the unrestricted model (all variables)

R2r: the R2 from the restricted model (null hypothesis)

q: number of restrictions (number of β′s=0 under null hypothesis)

k: number of X variables in unrestricted model (all variables)

Calculating the F-statistic

Fq,(n−k−1)=((R2u−R2r)q)((1−R2u)(n−k−1))

R2u: the R2 from the unrestricted model (all variables)

R2r: the R2 from the restricted model (null hypothesis)

q: number of restrictions (number of β′s=0 under null hypothesis)

k: number of X variables in unrestricted model (all variables)

F has two sets of degrees of freedom:

- q for the numerator

- (n−k−1) for the denominator

Calculating the F-statistic II

Fq,(n−k−1)=((R2u−R2r)q)((1−R2u)(n−k−1))

Key takeaway: The bigger the difference between (R2u−R2r), the greater the improvement in fit by adding variables, the larger the F!

This formula is (believe it or not) actually a simplified version (assuming homoskedasticity)

- I give you this formula to build your intuition of what F is measuring

F-test Example I

- We'll use the

wooldridgepackage'swage1data again

# load in data from wooldridge packagelibrary(wooldridge)wages<-wooldridge::wage1# run regressionsunrestricted_reg<-lm(wage~female+northcen+west+south, data=wages)restricted_reg<-lm(wage~female, data=wages)F-test Example II

- Unrestricted model:

^Wagei=^β0+^β1Femalei+^β2Northeasti+^β3Northcen+^β4Southi

- Restricted model:

^Wagei=^β0+^β1Femalei

H0:β2=β3=β4=0

q=3 restrictions (F numerator df)

n−k−1=526−4−1=521 (F denominator df)

F-test Example III

- We can use the

carpackage'slinearHypothesis()command to run an F-test:- first argument: name of the (unrestricted) regression

- second argument: vector of variable names (in quotes) you are testing

# load car package for additional regression toolslibrary("car") # F-testlinearHypothesis(unrestricted_reg, c("northcen", "west", "south"))| Res.Df | RSS | Df | Sum of Sq | F | Pr(>F) |

| 524 | 6.33e+03 | ||||

| 521 | 6.17e+03 | 3 | 157 | 4.43 | 0.00438 |

Second F-test Example: Are Two Coefficients Equal?

- The second type of test is whether two coefficients equal one another

Example:

^wagei=β0+β1Adolescent heighti+β2Adult heighti+β3Malei

Second F-test Example: Are Two Coefficients Equal?

- The second type of test is whether two coefficients equal one another

Example:

^wagei=β0+β1Adolescent heighti+β2Adult heighti+β3Malei

- Does height as an adolescent have the same effect on wages as height as an adult?

H0:β1=β2

Second F-test Example: Are Two Coefficients Equal?

- The second type of test is whether two coefficients equal one another

Example:

^wagei=β0+β1Adolescent heighti+β2Adult heighti+β3Malei

- Does height as an adolescent have the same effect on wages as height as an adult?

H0:β1=β2

- What is the restricted regression?

^wagei=β0+β1(Adolescent heighti+Adult heighti)+β3Malei

- q=1 restriction

Second F-test Example: Data

# load in dataheightwages<-read_csv("../data/heightwages.csv")# make a "heights" variable as the sum of adolescent (height81) and adult (height85) heightheightwages <- heightwages %>% mutate(heights=height81+height85)height_reg<-lm(wage96~height81+height85+male, data=heightwages)height_restricted_reg<-lm(wage96~heights+male, data=heightwages)Second F-test Example: Data

- For second argument, set two variables equal, in quotes

linearHypothesis(height_reg, "height81=height85") # F-test| Res.Df | RSS | Df | Sum of Sq | F | Pr(>F) |

| 6.59e+03 | 5.13e+06 | ||||

| 6.59e+03 | 5.13e+06 | 1 | 959 | 1.23 | 0.267 |

Insufficient evidence to reject H0!

The effect of adolescent and adult height on wages is the same

All F-test I

summary(unrestricted_reg)## ## Call:## lm(formula = wage ~ female + northcen + west + south, data = wages)## ## Residuals:## Min 1Q Median 3Q Max ## -6.3269 -2.0105 -0.7871 1.1898 17.4146 ## ## Coefficients:## Estimate Std. Error t value Pr(>|t|) ## (Intercept) 7.5654 0.3466 21.827 <2e-16 ***## female -2.5652 0.3011 -8.520 <2e-16 ***## northcen -0.5918 0.4362 -1.357 0.1755 ## west 0.4315 0.4838 0.892 0.3729 ## south -1.0262 0.4048 -2.535 0.0115 * ## ---## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1## ## Residual standard error: 3.443 on 521 degrees of freedom## Multiple R-squared: 0.1376, Adjusted R-squared: 0.131 ## F-statistic: 20.79 on 4 and 521 DF, p-value: 6.501e-16- Last line of regression output from

summary()of anlm()object is an All F-test- H0: all β′s=0

- the regression explains no variation in Y

- Calculates an

F-statisticthat, if high enough, is significant (p-value<0.05) enough to reject H0

All F-test II

- Alternatively, if you use

broominstead ofsummary()oflmobject:glance()command makes table of regression summary statisticstidy()only shows coefficients

library(broom)glance(unrestricted_reg)| r.squared | adj.r.squared | sigma | statistic | p.value | df | logLik | AIC | BIC | deviance | df.residual |

| 0.138 | 0.131 | 3.44 | 20.8 | 6.5e-16 | 5 | -1.39e+03 | 2.8e+03 | 2.83e+03 | 6.17e+03 | 521 |

- "statistic" is the All F-test, "p.value" next to it is the p value from the F test